The SBI AURUM Metal Card | YAY or NAY?

We had already published an article on 15th January 2021 bearing the title 'SBI AURUM | A New Super Premium Card In The Making,' where we had jotted down the benefits and features of the AURUM Card. In case you missed it, you might want to read it by clicking here.

The AURUM card went live on 3rd February 2021, and the card details are now handy. That being said, we are happy to inform you that we are not making any changes to our aforementioned article that was published much before the card launch. The information we had then provided bears little or no flaws in it. However, we do need to elaborate on some of the Card's features in detail. Read on to find out.

The AURUM Card is a metal card and comes in a fine black matte finish with a golden dotted stripline that looks elegant. Mind you that to sleeve in the sleek-looking card in your pocket, one needs to shell out a hefty 11,800 (including taxes) bucks annually that can be reversed on annual spending of a whooping 12 Lakhs Rupees.

For sure, any card enthusiast will not agree to pay up the hefty joining and annual fee until and unless the card feature promises at least an equivalent return back. In this article, we do the math and leave it up to you to decide if it's worth it or not.

Welcome Benefits

- You are entitled to get 40,000 AURUM Reward Points worth Rs.10,000 on joining — Redeemable at Aurum Rewards Portal against booking flights, hotels, activities, making philanthropic donations, buying gift cards, and more.

- Value for each Reward Point stands at 0.25 Paise. This compensates for the one-time joining fee.

Complimentary Memberships

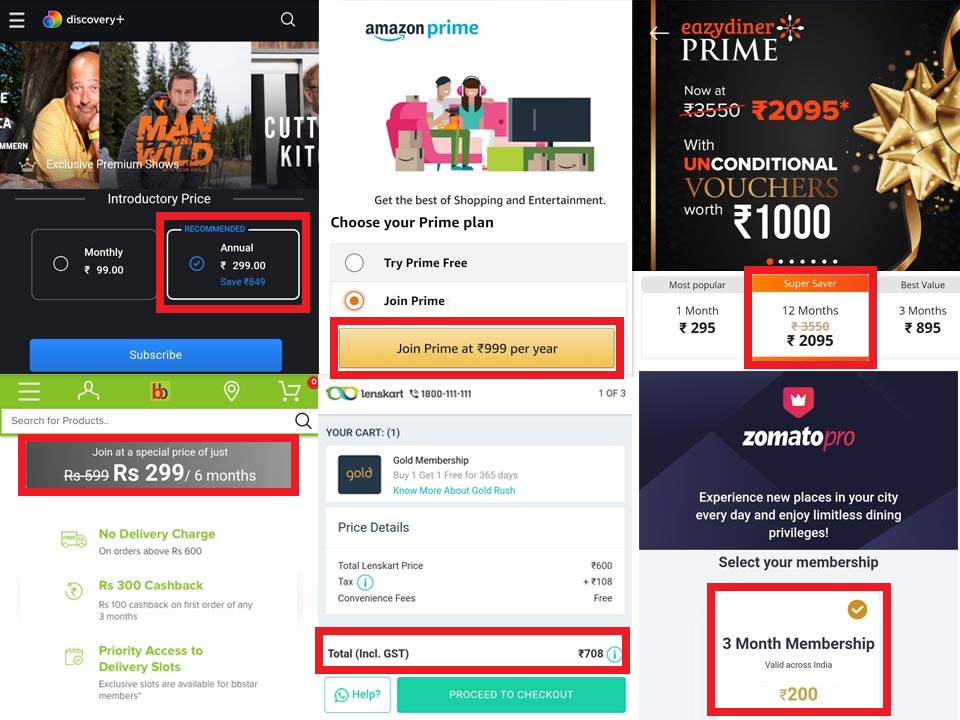

- AURUM Card offers Complimentary memberships for:

- As seen in the above membership pricing illustration, all the above memberships' aggregates to INR 5499 today, i.e., 5th February 2021.

Entertainment

- Free Movie tickets worth Rs. 12,000 every year, segregated into benefits worth INR 1,000 per month via BookMyShow.

- 4 free movie tickets per month or INR 1000 off, whichever is less.

- Offer is applicable on a maximum of 4 transactions in a month, with a maximum discount of INR 250 per ticket.

- Maximum 2 tickets can be availed in a transaction.

- The offer is available on all days of the week.

- Click here for the AURUM BookMyShow Offer page.

Milestone Benefits

- E-voucher on Monthly and Annual spend milestones from Victorinox, TATA Cliq, RBL, and Taj Experience.

Lounge Access

- One can access International Lounges n number of times; however, Domestic Lounges access has been capped at 4 visits per quarter. [citation required]

Fee Structure

- Joining Fee - INR 10,000 + Taxes

- Annual Fee - INR 10,000 + Taxes

- The annual fee gets waived on spending 12 Lakhs in a year.

CP's Take

- Various Memberships worth INR 5499

- BookMyShow Movie Tickets worth INR 12000

- TATA Cliq vouchers worth INR 18000

- RBL Voucher worth INR 5000

- Taj Voucher worth INR 10000

- Lounge Access Savings ~ INR 43000

Reviewed by Rahmat

on

February 05, 2021

Rating:

Reviewed by Rahmat

on

February 05, 2021

Rating:

No comments: