SBI BPCL Credit Card Vs BPCL SBI Card OCTANE | Comparison and Differences

After the successful endeavor of SBI BPCL Credit Card, SBI Cards has just launched the facelifted version of the beautiful fueling plastic money and named it 'BPCL SBI Card Octane.' We have already requested to update our BPCL Card to BPCL Octane Card as the latter offers much better reward rates, features and benefits.

In this article, we highlight the differences between these two fuel cards that would help our readers to decide if they want to upgrade or not.

Welcome Gift

While the BPCL Card offers 2,000 Activation Bonus Reward Points worth Rs. 500 on payment of joining fee, the BPCL Octane Card offers 6,000 Bonus Reward Points; equivalent to INR 1500 on payment of annual fees.

Basically, both the cards take care of the annual fee for the first year against the BRP they offer on card activation.

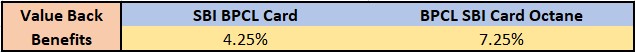

Value Back Benefits

The SBI BPCL Card maintains a value back of 4.25% ~ 13X Reward Points + 1% Fuel surcharge waiver on fuel purchases at BPCL petrol pumps. Also, the maximum Reward Points per billing cycle has been capped at 1300 RPs.

Whereas, the SBI BPCL Octane Card maintains a value back of 7.25% ~ 25X Reward Points + 1% Fuel surcharge waiver on fuel purchases at BPCL petrol pumps. Also, the maximum Reward Points per billing cycle has been capped at 2500 RPs.

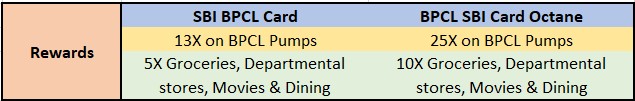

Reward Benefits

While with SBI BPCL Card, one can garner 5X Reward Points on every Rs. 100 spent at Groceries, Departmental stores, Movies & Dining, with SBI BPCL Octane Card the RPs gets doubled, i.e., 10X RPs.

Other retail purchases will fetch 1 Reward Point per Rs. 100 on both the cards where 1RP = 0.25 P.

Fuel Surcharge Waiver

Fuel Surcharge Waiver on both the cards remains 1% subjected to a maximum waiver of Rs. 100 in a month, which is equivalent to an Annual Savings of Rs. 1200.

While there's no minimum purchase threshold on both the card variants, the Surcharge Waiver is applicable only on transactions up to Rs. 4,000 per swipe.

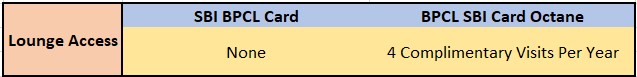

Lounge Access Benefit

SBI BPCL Octane Card comes powered with VISA Signature, which will enable the cardholder to access domestic Airport Lounges 4 times in a calendar year restricted to a single visit per quarter. However, the SBI BPCL Card does not offer any complimentary lounge access.

Milestone Benefits

SBI BPCL Octane Cardholders can enjoy Gift Vouchers worth Rs 2,000 from Aditya Birla Fashion or Yatra or Urban Ladder or Hush Puppies, or Bata on spending INR 3 Lakhs annually, but SBI BPCL Card does not offer any such milestone benefits.

Bottomline

After accounting for the above difference, selecting the better card is no rocket science. If you are a fuel person and a travel enthusiast, having the Octane variant by shelling 1000 bucks extra on an annual fee will save you a good amount of funds.

Moreover, charging 3L on your card annually is not a very big deal; doing so, you can save Rs 3500 (2K EGV + 1.5K Annual fee), which won't be an option even if you spend 10L annually on BPCL Card.

Further, because the Octane version comes powered with VISA Signature, it should provide certain offers at BookMyShow such as 'VISA BLOCKBUSTER WEEKENDS OFFER.' Not sure why SBI Cards has not mentioned it on their website. We will update you regarding this after confirmation. In the meanwhile, we are anticipating your inputs.

Should you require any further information, please do not hesitate to drop us a line in the comment section below. Alternatively, you can also write to us at admin@chargeplate.in.

Thanks for reading!

Related Articles:

SBI BPCL Credit Card Vs BPCL SBI Card OCTANE | Comparison and Differences

Reviewed by Rahmat

on

December 16, 2020

Rating:

Reviewed by Rahmat

on

December 16, 2020

Rating:

Reviewed by Rahmat

on

December 16, 2020

Rating:

Reviewed by Rahmat

on

December 16, 2020

Rating:

No comments: