Is Dhani Pay Prepaid Card worth it? Find out at ChargePlate

This article is the updated version of Dhani Super Saver Prepaid Card | Comprehensive Review. You might want to read it by clicking here.

What Dhani Pay Offered Earlier?

When launched, Dhani Pay offered a 5% cashback up to Rs. 1250 across a host of categories. The monthly fee was as low as Rs 250. It assured a savings of Rs. 1000 per month and attracted a lot of sign-ups.

Monthly fee | Maximum Cashback | |

INR 250 | 5% up to INR 1250 per month | |

When a significant number of people started using the so-called Super Saver Prepaid Card, without any prior intimation, Dhani Pay silently reduced the maximum monthly cashback to just Rs. 500 from Rs 1,250 that it offered earlier. But, interestingly, the monthly fee of Rs. 250 stayed intact, resulting in an effective cashback of just Rs. 250 per month.

Monthly fee | Maximum Cashback | |

INR 250 | 5% up to INR 500 per month | |

What Dhani Pay Offers Now?

With that latest development, Dhani Pay's user count took a free-fall. That was obvious because nowadays, people do not get inclined towards anything that doesn't hold a notable return. Panicked! Dhani Pay waived off the monthly fee of INR 250 but reduced the cashback percentage from 5% to 2%.

Monthly fee | Maximum Cashback | |

NIL | 2% (Unlimited) | |

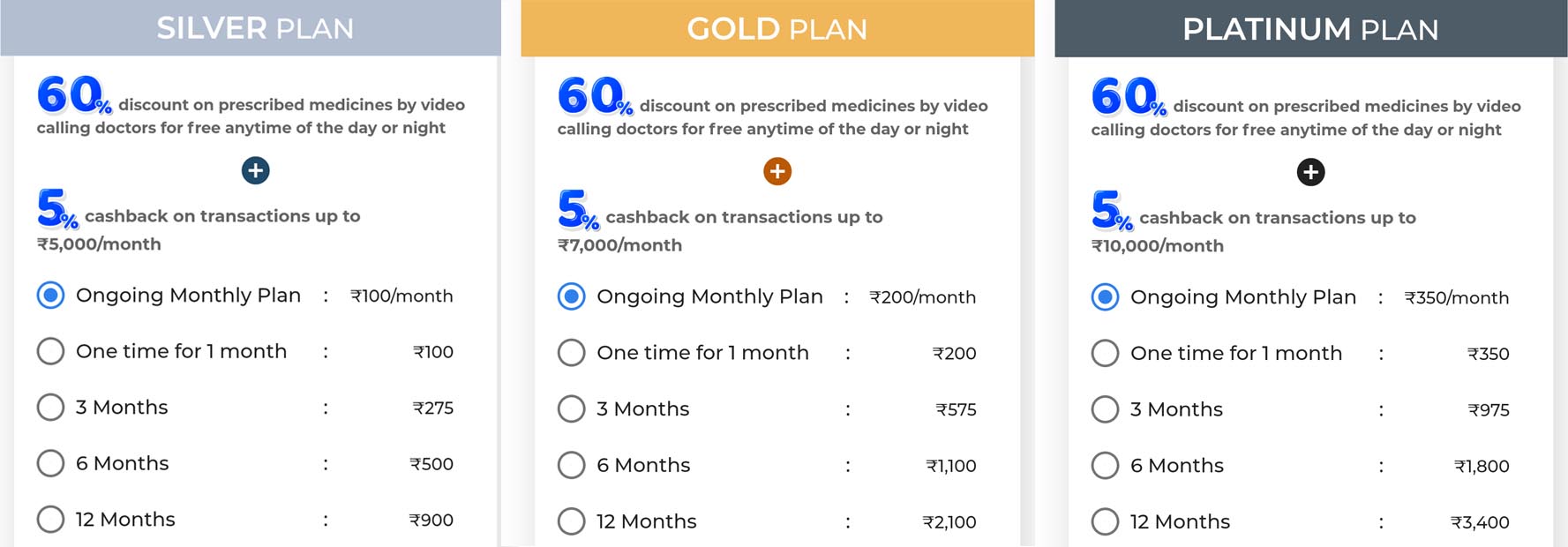

Additionally, Dhani Pay introduced another three paid subscription plan, Silver, Gold and Platinum. All these three plans offer a 5% cashback, but the maximum cashback threshold has been capped for each plan. One can also opt to subscribe for a plan with a longer tenure to save some extra bucks. Illustrated below.

Taking the above plans into consideration, we have illustrated below, the maximum savings that one can avail of with Dhani Pay Prepaid Card by opting the yearly plan.

|

Plan |

Yearly Fee |

Max CB P/M |

Total CB P/A |

Total Savings |

|

Silver |

INR

900 |

5%

of 5000 = 250 |

250

× 12 = 3000 |

3000

– 900 =2100 |

|

Gold |

INR

2100 |

5%

of 7000 = 350 |

350

× 12 = 4200 |

4200

– 2100 = 2100 |

|

Platinum

|

INR

3400 |

5%

of 10000 = 500 |

500

× 12 = 6000 |

6000

– 3400 = 2600 |

Bottomline

Earlier, the Dhani Pay Prepaid Card seemed very attractive and we had given our feedback accordingly but unfortunately they couldn't maintain the perks for even a single year after it's launch, Changing plan and cashback criteria so often and that too without any prior intimation feels like a deception towards Dhani Pay cardholders.

Furthermore, we suppose people are not so dumb to keep using the Dhani Card for these cashbacks in the size of a peanut. And as said earlier in our Dhani Pay article, we hold both Amazon Pay Credit Card for our shopping needs at Amazon and Flipkart Axis Bank Credit Card for our shopping at Flipkart. For utility bills and mobile recharges, we use the Payzapp card and get 5% and 10% cashback, respectively. When most of our requirements are already being discounted with the help of other financial instruments, we see no point in carrying this extra headache.

However, if 2% cashback on your spends satisfies your zeal, you can opt it.

Thanks for reading!

INTERLINKED ARTICLE: Dhani Super Saver Prepaid Card | Comprehensive Review

Is Dhani Pay Prepaid Card worth it? Find out at ChargePlate

Reviewed by Rahmat

on

April 29, 2021

Rating:

Reviewed by Rahmat

on

April 29, 2021

Rating:

Reviewed by Rahmat

on

April 29, 2021

Rating:

Reviewed by Rahmat

on

April 29, 2021

Rating:

No comments: