Understanding the FICO Score: A Guide to Your Financial Health

In today's financial landscape, credit scores play a pivotal role in determining one's ability to access credit, secure favorable interest rates, and achieve various financial goals. Among the myriad credit scoring models, the FICO Score stands out as one of the most widely used and influential metrics. In this comprehensive guide, we delve into the intricacies of the FICO Score, unraveling its significance, components, calculation methods, and the strategies to improve it.

What is a FICO Score?

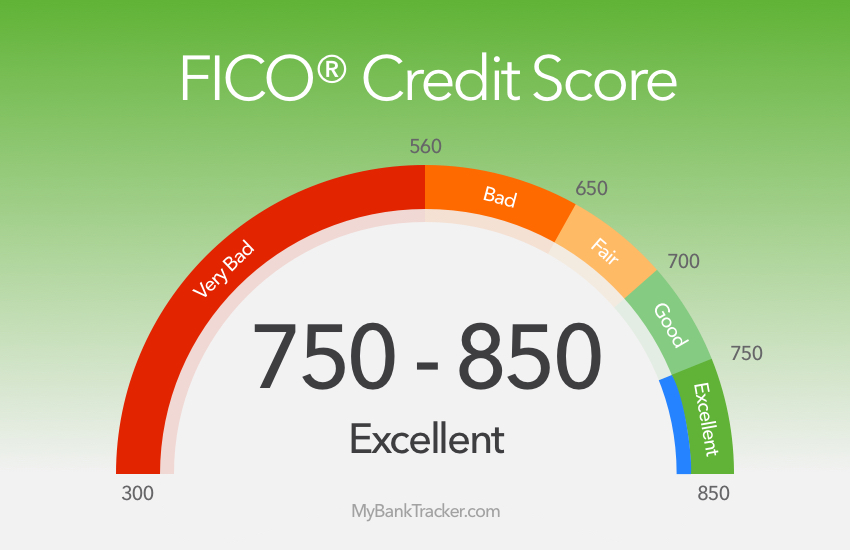

The Fair Isaac Corporation (FICO) introduced the FICO Score in 1989 as a standardized measure of an individual's credit risk. It serves as a numerical representation of one's creditworthiness, ranging from 300 to 850, with higher scores indicating lower credit risk and vice versa. Lenders across various industries, including mortgage, auto loans, credit cards, and personal loans, rely on FICO Scores to assess the likelihood of timely repayment by borrowers.

Components of the FICO Score:

Understanding the composition of the FICO Score is essential for comprehending its implications and devising effective strategies for improvement. The score comprises five key components, each carrying a different weightage:

1. Payment History (35%): This component evaluates the consistency and timeliness of your past credit payments. It considers factors such as the presence of any late payments, delinquencies, bankruptcies, or accounts in collections.

2. Amounts Owed (30%): This segment assesses your overall debt burden relative to your available credit. It takes into account factors such as credit utilization ratio, outstanding balances on credit accounts, and the number of accounts with balances.

3. Length of Credit History (15%): The length of your credit history reflects the duration for which you've been managing credit accounts. A longer credit history typically correlates with a higher FICO Score, provided that the payment history is positive.

4. Credit Mix (10%): FICO Scores consider the diversity of credit accounts in your portfolio, including credit cards, installment loans, mortgage loans, and retail accounts. A balanced mix of credit types may positively impact your score.

5. New Credit (10%): This component examines your recent credit inquiries and newly opened accounts. Multiple inquiries within a short timeframe or a flurry of new accounts may signal increased credit risk.

Calculating the FICO Score:

The exact algorithms used to calculate FICO Scores are proprietary to the Fair Isaac Corporation. However, the underlying methodology emphasizes predictive modeling based on historical credit data. FICO Scores are generated using complex algorithms that analyze information from credit reports provided by the three major credit bureaus: Equifax, Experian, and TransUnion.

Improving Your FICO Score:

While improving your FICO Score requires time and diligence, implementing certain strategies can yield tangible results over time:

1. Pay bills on time: Consistently meeting payment deadlines is paramount for maintaining a positive payment history, the most influential factor in FICO Score calculation.

2. Reduce debt: Lowering your credit card balances and overall debt can positively impact your credit utilization ratio, a key determinant of the Amounts Owed component.

3. Avoid opening new accounts frequently: Limiting new credit inquiries and account openings can prevent unnecessary fluctuations in your FICO Score.

4. Monitor your credit report: Regularly reviewing your credit report allows you to identify inaccuracies, dispute errors, and detect potential signs of identity theft or fraud.

Conclusion:

The FICO Score serves as a crucial benchmark in the realm of consumer credit, influencing lending decisions, interest rates, and financial opportunities. By gaining a deeper understanding of its components, calculation methods, and improvement strategies, individuals can take proactive steps to enhance their financial health and achieve their long-term goals. Remember, a strong FICO Score isn't built overnight but through consistent financial discipline and responsible credit management.

Reviewed by Rahmat

on

February 24, 2024

Rating:

Reviewed by Rahmat

on

February 24, 2024

Rating:

No comments: